Cash App Available Countries: Where Can You Use Cash App?

Cash App has revolutionized how people manage their finances, offering a seamless way to send, spend, and save money. However, its availability is not universal. Understanding which countries support Cash App is crucial for users who travel or conduct business internationally. This article provides a comprehensive overview of Cash App available countries, ensuring you know where you can leverage this popular mobile payment platform.

What is Cash App?

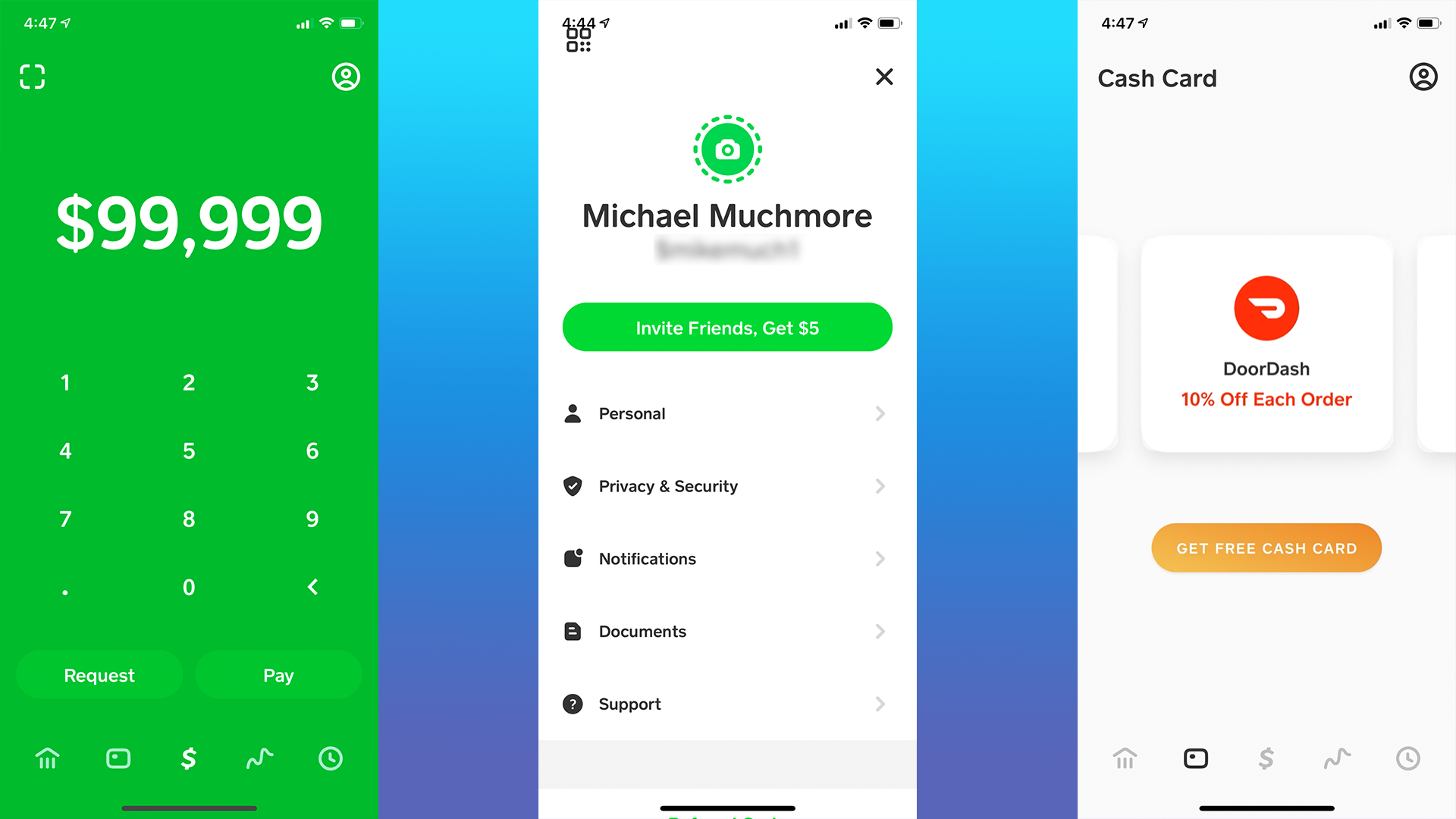

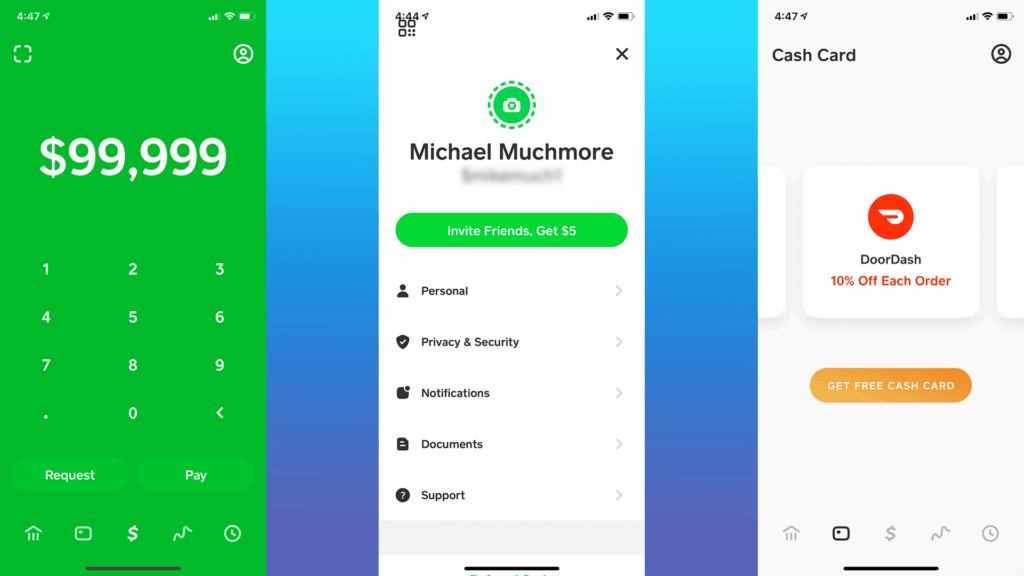

Cash App, developed by Block, Inc. (formerly Square, Inc.), is a mobile payment service that allows users to transfer money to one another using a mobile phone app. It is known for its user-friendly interface and diverse features, including direct deposit, debit cards, and even investment options. The app’s popularity stems from its ease of use and the ability to quickly send and receive money.

Current Cash App Available Countries

As of the latest update, Cash App is primarily available in two countries:

- United States: The United States is the primary market for Cash App. All features are fully functional within the U.S.

- United Kingdom: Cash App also operates in the United Kingdom, offering similar functionalities as in the U.S., although some features may vary.

It’s important to note that while the app can be downloaded and potentially accessed from other countries, its core functionalities, such as sending and receiving money, are limited to these two regions. Attempting to use Cash App outside of the United States and the United Kingdom may result in transaction failures or account restrictions.

Why is Cash App Limited to Certain Countries?

The limited availability of Cash App is due to several factors:

- Regulatory Compliance: Financial services apps must comply with various regulations in each country they operate in. This includes adhering to local laws regarding money laundering, data privacy, and consumer protection. Expanding to new countries requires navigating complex legal frameworks.

- Banking Infrastructure: The app relies on established banking infrastructure to facilitate transactions. The compatibility and integration with local banking systems are essential for smooth operations.

- Market Analysis: Before launching in a new country, Cash App conducts thorough market research to assess demand, competition, and potential profitability. This helps them make informed decisions about expansion.

- Security Concerns: Ensuring the security of transactions and user data is paramount. Expanding to new regions involves addressing potential security risks and implementing appropriate safeguards.

Future Expansion of Cash App

While Cash App is currently limited to the United States and the United Kingdom, there are ongoing discussions and speculations about potential expansion into other countries. However, Block, Inc. has not officially announced any concrete plans for immediate expansion. Users in other regions are eagerly awaiting news about when Cash App might become available in their countries.

How to Check if Cash App is Available in Your Country

The most reliable way to confirm if Cash App is available in your country is to visit the official Cash App website or check the app stores (Apple App Store and Google Play Store). If the app is not available for download in your region, it is likely not supported. Additionally, you can refer to the Cash App’s official help center or contact their customer support for up-to-date information.

Alternatives to Cash App in Other Countries

If Cash App is not available in your country, several alternative mobile payment apps offer similar functionalities. Some popular alternatives include:

- PayPal: A widely used international payment platform that allows users to send and receive money globally.

- Venmo: Another popular app, primarily used in the United States, for sending and receiving money between friends and family. [See also: Venmo Alternatives]

- Zelle: A U.S.-based service that allows direct bank-to-bank transfers.

- Skrill: An e-commerce payment system that supports international money transfers.

- WorldRemit: A service focused on international money transfers, particularly for sending money to family and friends abroad.

- Wise (formerly TransferWise): A platform that facilitates international money transfers with competitive exchange rates.

Tips for Using Cash App While Traveling

If you are a U.S. or U.K. resident and plan to travel outside of these Cash App available countries, keep the following in mind:

- Functionality Limitations: While you may be able to access the app, sending and receiving money may be restricted.

- Currency Conversion: Be aware of potential currency conversion fees if you use your Cash App debit card for purchases in a foreign currency.

- Security: Always use secure Wi-Fi networks when accessing your Cash App account to protect your financial information.

- Customer Support: If you encounter any issues, contact Cash App customer support for assistance.

Understanding Cash App’s Geographic Restrictions

Understanding the geographic restrictions of Cash App is essential for anyone who relies on the app for financial transactions. While the app offers convenience and versatility, its availability is limited to the United States and the United Kingdom. Users should explore alternative options if they reside or travel outside of these regions.

Cash App Features and Availability

The features offered by Cash App can vary slightly between the United States and the United Kingdom. For example, certain investment options or promotional offers may be exclusive to one country. Users should familiarize themselves with the specific features available in their region.

The Future of Mobile Payment Apps and Global Expansion

The mobile payment industry is continuously evolving, with new apps and features emerging regularly. As technology advances and regulatory landscapes change, it is likely that more mobile payment apps will expand their services globally. This would provide users with greater flexibility and convenience when managing their finances internationally.

Staying Updated on Cash App Availability

To stay informed about the latest updates on Cash App available countries and any potential expansion plans, it is recommended to follow official announcements from Block, Inc., subscribe to industry news, and regularly check the Cash App website and app store listings. This will ensure you have the most accurate and up-to-date information.

Conclusion

In conclusion, Cash App is currently available in the United States and the United Kingdom. While its limited availability may be a drawback for some users, the app remains a popular choice for mobile payments within these regions. As the mobile payment industry continues to grow, it is hoped that Cash App and other similar apps will expand their services to more countries in the future, providing greater convenience and accessibility to users worldwide. Always verify the app’s availability in your specific location before relying on it for financial transactions. Keep an eye on official announcements for any changes regarding Cash App available countries. Remember to explore alternatives if Cash App isn’t available where you are. The landscape of Cash App available countries is subject to change, so staying informed is key.