Cash App Available Countries: A Comprehensive Guide

Cash App has revolutionized the way people handle their finances, offering a convenient platform for sending, receiving, and managing money. However, its accessibility is limited by geographical boundaries. Understanding which countries Cash App operates in is crucial for users looking to leverage its features. This guide provides a comprehensive overview of Cash App available countries, shedding light on its current reach and potential expansion plans. Whether you’re a frequent traveler, an international business owner, or simply curious about the app’s global presence, this information will help you navigate the world of mobile payments with Cash App.

Current Cash App Availability

As of now, Cash App is primarily available in two countries: the United States and the United Kingdom. This limited availability can be frustrating for users outside these regions who are eager to experience the app’s functionalities. The company has not yet broadly expanded its services, focusing instead on solidifying its presence in its established markets. However, this doesn’t mean that expansion is off the table; it simply indicates a cautious and strategic approach to global growth.

United States

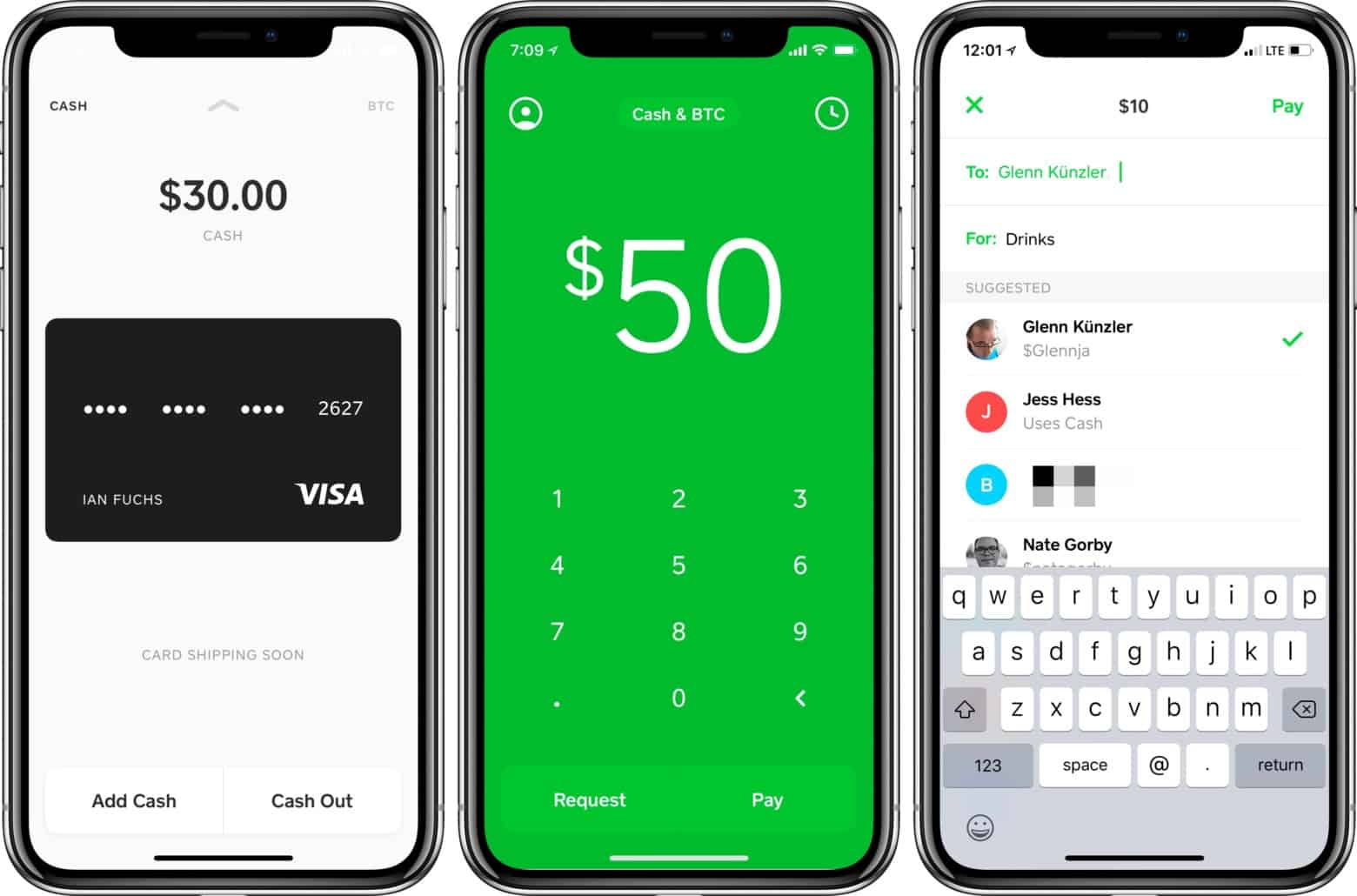

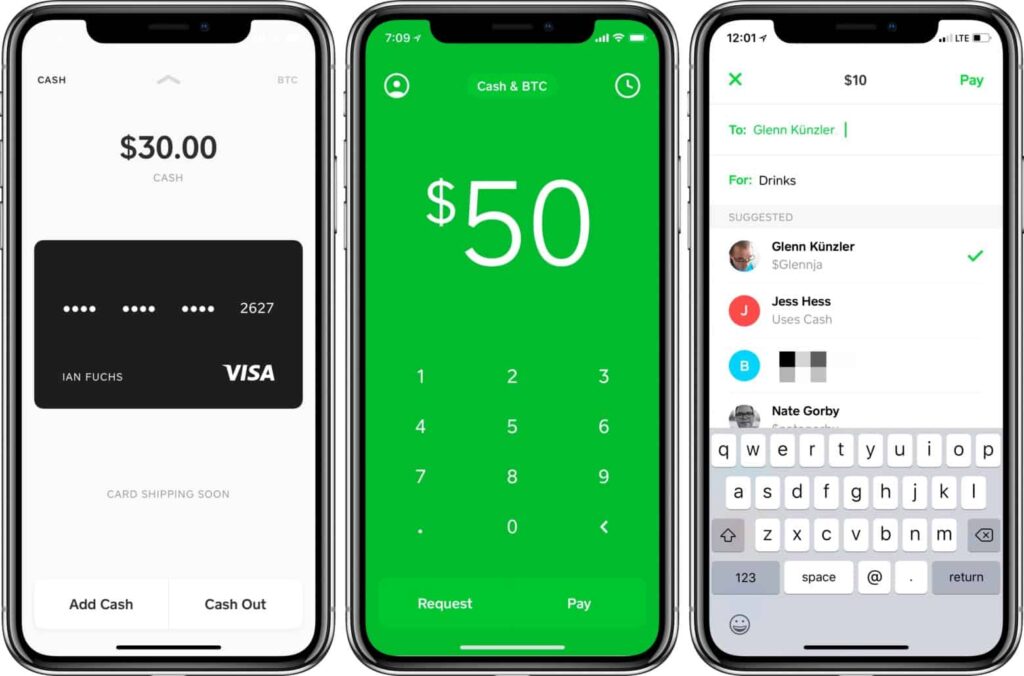

The United States is the birthplace and primary market for Cash App. Here, the app enjoys widespread adoption, with millions of users relying on it for various financial transactions. From splitting bills with friends to paying for goods and services, Cash App has become an integral part of the American financial landscape. Users in the US can access all of Cash App’s features, including sending and receiving money, investing in stocks, and trading Bitcoin. The app also offers a physical debit card, known as the Cash Card, which can be used for purchases both online and offline.

United Kingdom

The United Kingdom marks Cash App’s first foray into international markets. While the UK version of the app shares many similarities with its US counterpart, there are also some key differences. For instance, certain features, such as stock investing and Bitcoin trading, may not be available to UK users. Furthermore, the regulatory environment in the UK differs from that in the US, which necessitates certain adaptations to the app’s functionalities. Despite these differences, Cash App has gained considerable traction in the UK, offering a convenient alternative to traditional banking methods. The Cash App available countries list remains short, but the UK is a significant part of it.

Why is Cash App Limited to Certain Countries?

Several factors contribute to Cash App’s limited availability. These include regulatory compliance, market competition, and technological infrastructure. Expanding into new countries requires navigating complex legal frameworks and adapting the app to local financial regulations. Moreover, Cash App faces stiff competition from established players in the mobile payment space, which can make it challenging to gain market share. Finally, the app relies on robust technological infrastructure to function effectively, and this infrastructure may not be readily available in all countries.

Regulatory Compliance

Financial regulations vary significantly from country to country. Cash App must comply with these regulations to operate legally, which can be a time-consuming and expensive process. This includes obtaining the necessary licenses and permits, implementing anti-money laundering (AML) measures, and adhering to data privacy laws. The complexity of regulatory compliance is a major barrier to entry for Cash App in many countries. The company must ensure that its operations align with local laws and regulations, which requires significant investment in legal and compliance resources. This is a key consideration when evaluating Cash App available countries.

Market Competition

The mobile payment market is highly competitive, with numerous players vying for market share. In many countries, established companies already offer similar services to Cash App, making it difficult for the app to gain traction. These competitors may have a strong brand presence, a large user base, and established relationships with local merchants. Cash App must differentiate itself from these competitors to attract users, which requires a compelling value proposition and effective marketing strategies. The competitive landscape is a critical factor in determining where Cash App chooses to expand its operations. Understanding the existing market dynamics is essential for successful market entry.

Technological Infrastructure

Cash App relies on robust technological infrastructure to function effectively. This includes reliable internet connectivity, secure payment processing systems, and advanced fraud detection mechanisms. In countries where this infrastructure is lacking, it may be difficult for Cash App to operate efficiently. The app requires a stable and secure environment to ensure that transactions are processed smoothly and that users’ data is protected. Investing in the necessary infrastructure can be costly, which may deter Cash App from expanding into certain regions. The availability of reliable technology is a prerequisite for successful operation. This directly impacts the list of Cash App available countries.

Future Expansion Plans

While Cash App is currently limited to the United States and the United Kingdom, there is potential for future expansion. The company has not explicitly announced any specific plans, but it is likely that they are exploring opportunities in other countries. Factors that could influence Cash App’s expansion plans include market demand, regulatory environment, and competitive landscape. As the mobile payment market continues to grow, Cash App may see opportunities to expand its reach and offer its services to a wider audience. The company’s strategic decisions will be guided by a careful assessment of these factors. The future list of Cash App available countries remains to be seen.

Potential Target Markets

Several countries could be potential target markets for Cash App. These include countries with a high adoption rate of mobile payments, a favorable regulatory environment, and a large population of smartphone users. For example, countries in Europe, Asia, and Latin America could be attractive markets for Cash App. These regions offer significant growth potential and align with the app’s mission of providing accessible financial services to a global audience. However, the company must carefully evaluate the risks and opportunities associated with each market before making a decision. Thorough market research is essential for identifying the most promising expansion opportunities.

Challenges to Expansion

Expanding into new countries is not without its challenges. Cash App must overcome regulatory hurdles, navigate cultural differences, and compete with established players in the mobile payment space. The company must also adapt its app to local languages, currencies, and payment methods. These challenges require significant investment in resources and expertise. Cash App must be prepared to address these challenges to successfully expand its operations. Overcoming these obstacles is crucial for realizing the app’s global potential. The complexity of these challenges affects the pace at which Cash App available countries are added.

How to Check Cash App Availability

The easiest way to check whether Cash App is available in a particular country is to visit the official Cash App website or download the app from the app store. If the app is not available in your country, it will not appear in the app store. You can also check Cash App’s help center or contact customer support for more information. Staying informed about the app’s availability is essential for users who are considering using Cash App for international transactions. The official sources provide the most accurate and up-to-date information. Verifying the availability ensures that you can access and use the app’s features without any issues. Always confirm the Cash App available countries through official channels.

Official Cash App Website

The official Cash App website is the most reliable source of information about the app’s availability. The website provides a list of countries where Cash App is currently supported. It also offers information about the app’s features, fees, and security measures. Visiting the website is a quick and easy way to check whether Cash App is available in your country. The website is regularly updated with the latest information, ensuring that users have access to accurate and current details. Checking the official website is the first step in verifying the app’s availability.

App Store

The app store is another way to check whether Cash App is available in your country. If the app is not available, it will not appear in the app store when you search for it. This is a simple and straightforward way to determine whether Cash App is supported in your region. The app store automatically filters apps based on your location, so you will only see apps that are available in your country. This makes it easy to identify whether Cash App is accessible to you. Using the app store as a check is a convenient and reliable method.

Alternatives to Cash App in Unavailable Countries

If Cash App is not available in your country, there are several alternative mobile payment apps that you can use. These include PayPal, Venmo, Zelle, and Google Pay. Each of these apps offers similar features to Cash App, allowing you to send and receive money, pay for goods and services, and manage your finances. The best alternative for you will depend on your specific needs and preferences. Researching the available options is essential for finding the app that best suits your requirements. Consider factors such as fees, security measures, and user interface when making your decision.

PayPal

PayPal is one of the most widely used mobile payment platforms in the world. It is available in over 200 countries and supports a wide range of currencies. PayPal offers a secure and convenient way to send and receive money online. It also provides buyer protection, which can help protect you from fraud. PayPal is a popular alternative to Cash App for international transactions. Its global reach and robust security features make it a reliable choice for users around the world. The extensive availability of PayPal makes it a versatile option.

Venmo

Venmo is another popular mobile payment app that is primarily used in the United States. It is owned by PayPal and offers similar features to Cash App. Venmo is known for its social features, which allow you to share your transactions with friends. However, Venmo is not as widely available as PayPal. It is primarily targeted at users in the US. While Venmo is a popular choice, its limited availability restricts its use in many countries. Check the app’s availability in your region before relying on it for transactions.

Conclusion

In conclusion, Cash App available countries are currently limited to the United States and the United Kingdom. While there is potential for future expansion, the company faces several challenges, including regulatory compliance, market competition, and technological infrastructure. Users outside of these countries can explore alternative mobile payment apps such as PayPal and Venmo. Staying informed about Cash App’s availability and exploring alternative options is essential for navigating the world of mobile payments. As the mobile payment market continues to evolve, it will be interesting to see how Cash App adapts and expands its reach. Keep an eye on official announcements and updates to stay informed about future developments. Understanding the current limitations and potential alternatives is crucial for making informed decisions about your financial transactions. This knowledge empowers you to choose the best payment solution for your needs, regardless of your location. Therefore, always verify the Cash App available countries before attempting to use the service.

[See also: Understanding Cash App Fees]

[See also: How to Secure Your Cash App Account]

[See also: Cash App vs. Venmo: Which is Better?]